Featured Post from Mason Cook, NMotion Managing Director

We created this post to help applicants understand how we selected the most recent NMotion Growth Accelerator cohort. What's even more exciting is that startup founders can use the same criteria to grow their companies with or without investors.

What you’ll learn in this post:

Our selection process for NMotion Growth Accelerator

Some truths about venture capital

Ways to strengthen your business (and application)

Action items you can take today to help you succeed

Bees make the honey, not the bee keepers

As a startup founder, you have a lot in common with bees. Those of us investors and accelerators are more like bee keepers. While we can help create better bee habitats, the bees are the ones who search for nectar and make the honey.

Never forget that you are the one who makes things happen, not the bee keepers. That’s why we are offering up these insights and thoughts. We want to help you become better bees (aka startup founders) and grow your company.

No matter what happens, keep driving revenue and growing as a leader!

Our Selection Process

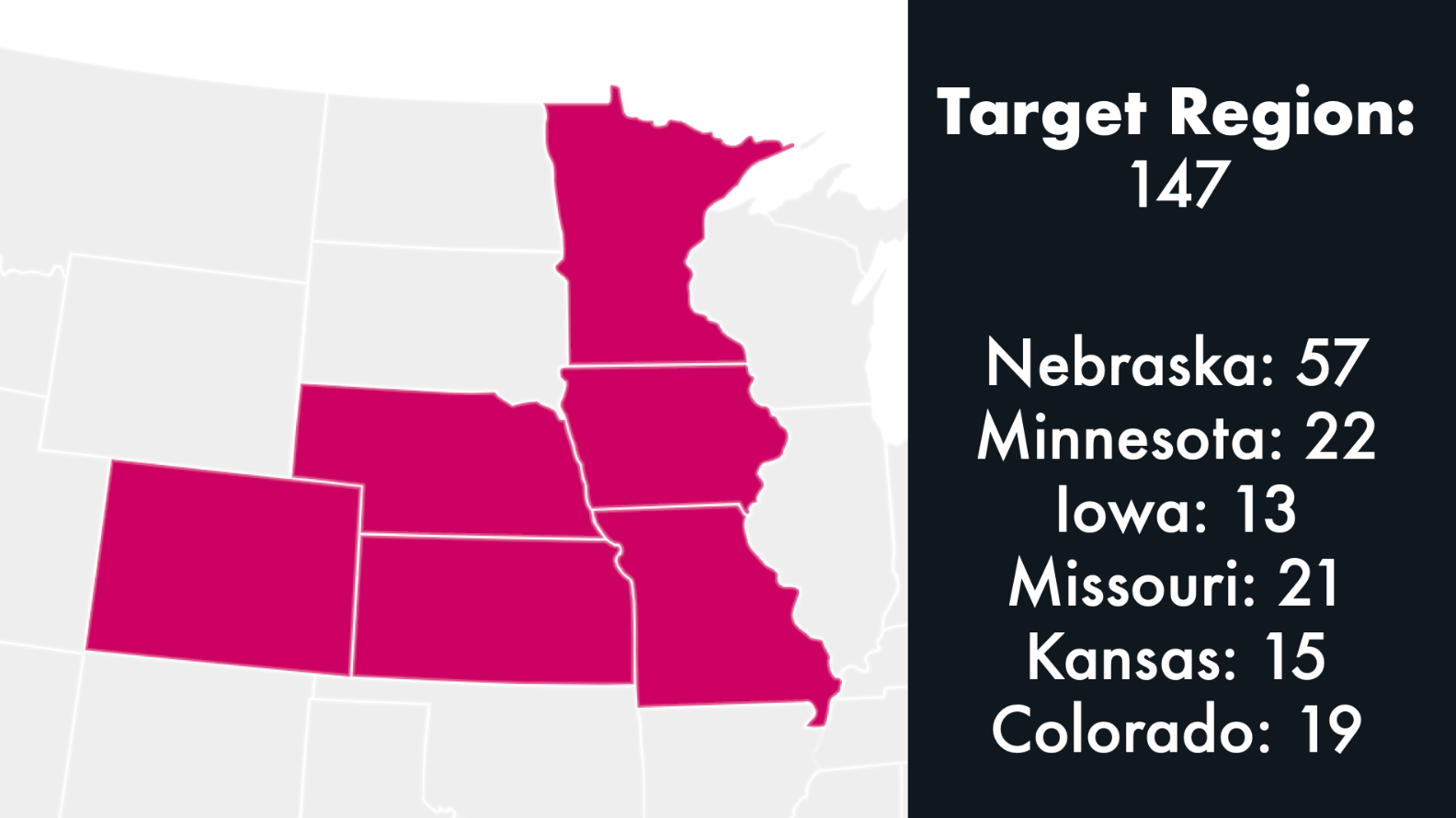

The gener8tor ethos is to leave no stone unturned when it comes to finding the best and brightest in the communities we serve. For the NMotion Growth Accelerator 2023 Cohort, we identified 2,700 prospective companies in a six-state region and directly connected with 2,300 of them which resulted into 1:1 office hours with 271.

As the only early-stage industry agnostic startup accelerator actively operating in Nebraska, Iowa, Kansas, and Missouri, we attracted a large, high-quality applicant pool of startups mostly from the region. The 217 applications set a new record for NMotion (up from 179 in 2022) with twice as many in Nebraska alone as compared to last year.

Lesson: Don’t sleep on the gr8 Plains!

Working from gener8tor’s thesis of finding the best and brightest across race, place, and gender, NMotion is proud of these results:

71.75% Underrepresented Founders

30% Female Founders

67.75% from the Target Geography (NE, CO, KS, MO, IA, MN)

Equally important was the diversity of perspectives we leveraged to select from this pool. Anywhere from 3-7 different individuals on the NMotion/gener8tor team reviewed every application:

50% Female (11 out of the 22 reviewers)

31% POC (7 out of 22 reviewers)

Some Truths about Venture Capital

We have objective criteria and apply them subjectively

No one knows the future

We deal with possibilities and unknowns so all of our decisions are imperfect

For accelerators, we look for a mix of market opportunities to diversity the cohort

Keep these truths in mind the next time an investor or accelerator passes on you. While rejection still stings, don’t let it stop you. Prove them wrong!

FIVe Ways to strengthen your business (and application)

#1: You can’t spell traction without action

Are your customers taking an action that signals the market is interested in your solution and that you can execute on delivering that solution?

To create better traction, you can focus on:

Ship, ship, ship: Focus on developing a minimum viable product (MVP) as quickly as possible, then iterating and improving based on user feedback.

Ring the cash register: Focus on obtaining one customer – whether it be a paying customer, a pilot project, or a letter of intent. Paying customers are a better indicator of market validation than a non-paying one, and non-paying customers are better than nothing.

#2: Do you have a lean, well-rounded team in place with the ability to go the distance?

Typically, the most successful, capital-efficient founding teams have a team that contains these three personas (often with folks having more than one):

Dealmaker - customer growth/sales

Developer - product/tech development

Designer - customer experience

Assemble a skills grid of your founding team and recruiting to fill any gaps. You want a well-rounded team, not lopsided.

#3 Is there a path to $100M+ in annual revenue?

Venture investing about finding companies tackling large market opportunities and have demonstrated they can grow exponentially. That’s why we’re so focused on big ideas and teams who have big ambitions.

One of the tricks is to take a bottoms-up approach to show how large of a market opportunity you’re tackling. Starting from the ground and looking up helps you to discover paths to climbing that mountain.

The bottom-up formula is simple but isn’t always easy to solve.

X * Y = Z

X = # of customers

Y = Annual revenue per customer

Z - Total addressable market

If your market size is too small, you have two levers to increase it:

Increase the amount of revenue generated by each customer by changing your pricing

Increase the amount of potential customers by expanding into new markets or industries

#4: Are your resources and energy aligned with generating revenue?

Why does capital efficiency matter? It’s the north star metric for your upside as a founder and the catchall for troubleshooting. (READ: You’ll make more money when you exit)

You can create greater capital efficiency by avoiding four common faux-pas:

Building product for scale before obtaining your first customer

A founding team with lopsided skill sets

Optimizing for valuation instead of revenue

Not tracking revenue or customers as a KPI

#5: Will our investment of time, money, and network bring an outsized advantage to your company?

Again, I encourage you to remember that you are the bee. You are the one who is collecting the nectar and making the honey. You should always ask yourself if a potential investor will bring you outsized returns. If they won’t, why would you give us or them an equity stake?

How else can we be of help to you?

Leave a comment here with any questions and thoughts.