Content made possible by

Kent Campbell and Victor Rivas, Quantum Qool

Kent Campbell and Victor Rivas are the co-founders of Quantum Qool and alumni from the NMotion Accelerator 2023 cohort. Quantum Qool helps advanced electronics manufacturers battle their number one enemy, heat, using patented femtosecond (ultrashort bursts) laser structuring technology developed by Rivas.

Kent Campbell (left) and Victor Rivas (right) are the co-founders of Quantum Qool and alumni from the NMotion Accelerator 2023 cohort. This duo have navigated the past two years by leveraging their respective strengths.

Quantum Qool helps advanced electronics manufacturers battle their number one enemy, heat, using patented femtosecond (ultrashort bursts) laser structuring technology developed by Rivas. The technology creates more surface area, which significantly improves power and heat management by factors of 10 times or more.

As advanced electronics become faster, smaller and more powerful, heat and power issues with components inside of batteries, CPUs & GPUs, solar arrays and spacecraft have become a glaring problem in terms of thermal management.

Higher power means higher operating temperatures, which causes performance issues, operation failures, shortened lifecycles and even direct dangers, such as fires and thermal runaway, costing billions of dollars in losses.

Without real innovation in manufacturing, components such as heat sinks, heat spreaders, heat pipes, electrodes, solar cells, and thermal radiators will not be able to sustainably handle more heat, along with diminishing energy capacity as we electrify our future.

To overcome the challenges of a hardware-driven startup, Quantum Qool has leveraged Victor’s longstanding relationships in the field and Kent’s experience building industry collaborations to make significant progress. Industry partners have contributed in-kind equipment and services, not only reducing development costs but opening up the opportunity to leverage those partners’ customer bases.

We caught up with Kent to see how things were going and to ask him to share his insights on a few topics.

1. If you could teleport back to when Victor and you started Quantum Qool, what advice would you give yourself?

It's always going to take longer than you originally thought, but you can also do way more than you originally imagined. Put your head down and do the work, but also stay open-minded on how you can reach the outcome you desire.

2. What has been the toughest decision you have had to make?

I don't know if there has been one really tough decision, but a series of smaller ones - when to raise capital, who to hire/fire, biz strategy, etc. - that you eventually have to stop debating and just make a decision and live with the consequences. Indecision is what kills you more than anything and can be paralyzing. Just have to decide and move forward.

3. Who do you lean on to help refuel and recharge your mind/body/spirit?

I lean on a number of people and honestly should do it even more: my family, my friends, and my fellow founders. You need to get different perspectives on situations and life in general, otherwise you get tunnel vision and can really get off track mentally and emotionally.

4. What hacks and tricks have you developed to connect with customers?

The biggest hack is to be politely persistent. Everyone is busy, everyone has a lot on their plate and is running 100mph. They're going to dismiss your email, your call, your message and if you give up on the first or even second try, you won't break through. Be polite, be personal and know what they actually do. The ones that matter will eventually give you a response you can work with.

Learn more about Quantum Qool here.

Ramsey Shaffer, Uptrends.ai

Ramsey Shaffer and Sam Cartford are the co-founders of Uptrends.ai and alumni from the NMotion 2023 Accelerator cohort. Uptrends offers an AI-powered stock sentiment dashboard and smart alerts to help you keep tabs on trending stocks and major events, before the crowd.

Ramsey Shaffer (pictured on right) and Sam Cartford (left) are the co-founders of Uptrends.ai and alumni from the NMotion 2023 Accelerator cohort. Uptrends offers an AI-powered stock sentiment dashboard and smart alerts to help you keep tabs on trending stocks and major events, before the crowd.

In the two years since joining NMotion, Uptrends has shifted from B2C to a B2B product. They have compiled an impressive library of YouTube content sentiment analysis to help professional fund managers find shifting trends faster.

Ramsey has also taken a strong swing at content creation to help drive awareness of the company, accelerate his learning curve, and hone his writing skills. If you haven’t already seen his series about Slawnearme.com, a cole slaw rating tool he built using only AI, here’s your chance to learn all about Ramsey’s passion for cole slaw - a surprisingly polarizing food item.

We caught up with Ramsey to see how things were going and to ask him to share his insights on a few topics. Enjoy!

If you could teleport back to when you started Uptrends, what advice would you give yourself?

Never stop putting yourself out there, trust your gut, ask as many questions as you can. Fail until you succeed, don't let pride get in your way. Above all, learn the right balance between opportunistically listening to the market and being laser focused on execution.

What has been the toughest decision you have had to make?

Pivoting and shutting down our first product. We launched Uptrends originally as a consumer-facing stock market news alerts platform. We quickly got to 25,000 users but struggled to monetize. We tried everything. After a while, we had to acknowledge it wasn't working. So we explored about a dozen other options, and ended up finding good early traction licensing long-form video market intelligence data to large institutional investors. We went all in on that new value prop, and ended up shutting down the original consumer app. That was a tough, bittersweet moment — on the one hand we'd reinvented our business and I'm very proud of that, but it's also never easy to kill your daisies and turn away those early customers.

Who do you lean on to help refuel and recharge your mind/body/spirit?

I'm grateful to have surrounded myself with good mentors and friends who can support, guide, and empathize. There's no such thing as a self-made man. Honestly I get a lot of energy and inspiration by talking with other founders in similar spots. Also my wife, she is awesome. Remember to call your grandma and your mom more often.

What hacks and tricks have you developed to connect with customers?

Distribution > Product. I think the most impactful things have been simply building in public, making content, trying to cultivate community. Growing organic distribution through content and authenticity is the biggest hack of all, especially in a world where AI makes it increasingly easy to build anything you want. Spend less time "selling" and more time building relationships and connecting vulnerably, that's the best investment you can make.

Learn more about Uptrends.ai here.

Carina Glover, HerHeadquarters

In 2017, Carina Glover sketched out an idea for what would launch as HerHeadquarters in 2019. Every step of the way, Carina has made the most of the opportunities she’s created through her tenacity and resilience to achieve a vision central to her life.

In 2017, Carina Glover sketched out an idea for what would launch as HerHeadquarters in 2019. Every step of the way, Carina has made the most of the opportunities she’s created through her tenacity and resilience to achieve a vision central to her life.

As the company website states:

We're here to give women-owned businesses more, without the fight.

Behind every opportunity a woman-owned business receives, there's a woman who had to fight for it. Without the constant obstacles, gatekeeping, and lack of opportunities, they'd have higher revenue, faster growth, and greater impact. HerHeadquarters gets in the ring and exists to be their ally.

Our platform, corporate services, and certification all have one common goal: to give women-owned businesses access to the money & opportunities they deserve, without the barriers.

Along the way, the United States Congress, Forbes, American Express, Beyonce's BeyGood, and more have recognized Carina and her team for their work.

Coming back from maternity leave after the birth of her second child this past month, we asked Carina to share what lessons she’s learned from her journey.

If you could teleport back to when you started HerHeadquarters, what advice would you give yourself?

There are two pieces of advice that I really needed to hear coming into this founder territory:

Give yourself grace during the tough times, expect them to come, but know that they will pass. Even when it doesn't look like it, remember that being disciplined about doing the work well and consistently will always reap a reward. Some rewards just take longer to produce.

Focus more on making money and less on the product & branding. Give something x amount of time to work and produce revenue/engagement and if it doesn't work, move to the next thing. Pivot faster, it means you're learning and adapting to what your audience needs.

What has been the toughest decision you have had to make?

Any decision that would impact the livelihood of my team and their household has always been hard. That never gets easier.

Who do you lean on to help refuel and recharge your mind/body/spirit?

I have a great village, sometimes my children and my husband refuel me, but on other days it might be a call with my advisor that makes me feel like I can get back in the ring or a conversation with one of my close friends who pour into me without even knowing I'm going through a hard time. Oftentimes, it's just the energy and aura of the right people that can recharge me.

Thank you Carina for sharing your story and insights. You can continue to inspire us!

Learn more about HerHeadquarters and share what they are doing with the companies and organizations who can help support women-owned businesses.

Jeff and Katy Tezak, Tiiga

Jeff and Katy Tezak from Tiiga are 2x NMotion alumni having completed the pre-accelerator gBETA Lincoln with their co-founder Harrounda Malgoubri and the NMotion Accelerator 2022 program.

Jeff and Katy Tezak from Tiiga are 2x NMotion alumni having completed the pre-accelerator gBETA Lincoln with their co-founder Harrounda Malgoubri and the NMotion Accelerator 2022 program. Jeff and Katy have grown tremendously as leaders while also growing their family. FYI - Jack is too cute.

This past fall, Tiiga unveiled a refreshed collection of products to help supercharge your gut health using the baobab superfruit. Originally, Tiiga was all about hydration, but they listened to consumer feedback and data to realize they were more than that. Tiiga is really a gut health powerhouse.

With the new focus, they created a new formula that increases the fiber from the baobab fruit, took out the sugar, lowered the sodium, and added coconut water powder. It’s quite tasty and refreshing. Check out and learn more.

How to Make Your Startup Standout

We created this post to help applicants understand how we selected the NMotion Accelerator 2023cohort. What's even more exciting is that startup founders can use the same criteria to grow their companies with or without investors.

We created this post to help applicants understand how we selected the NMotion Accelerator 2023cohort. What's even more exciting is that startup founders can use the same criteria to grow their companies with or without investors.

What you’ll learn in this post:

Our selection process for NMotion Accelerator

Some truths about venture capital

Ways to strengthen your business (and application)

Action items you can take today to help you succeed

Bees make the honey, not the bee keepers

As a startup founder, you have a lot in common with bees. Those of us investors and accelerators are more like bee keepers. While we can help create better bee habitats, the bees are the ones who search for nectar and make the honey.

Never forget that you are the one who makes things happen, not the bee keepers. That’s why we are offering up these insights and thoughts. We want to help you become better bees (aka startup founders) and grow your company.

No matter what happens, keep driving revenue and growing as a leader!

Our Selection Process

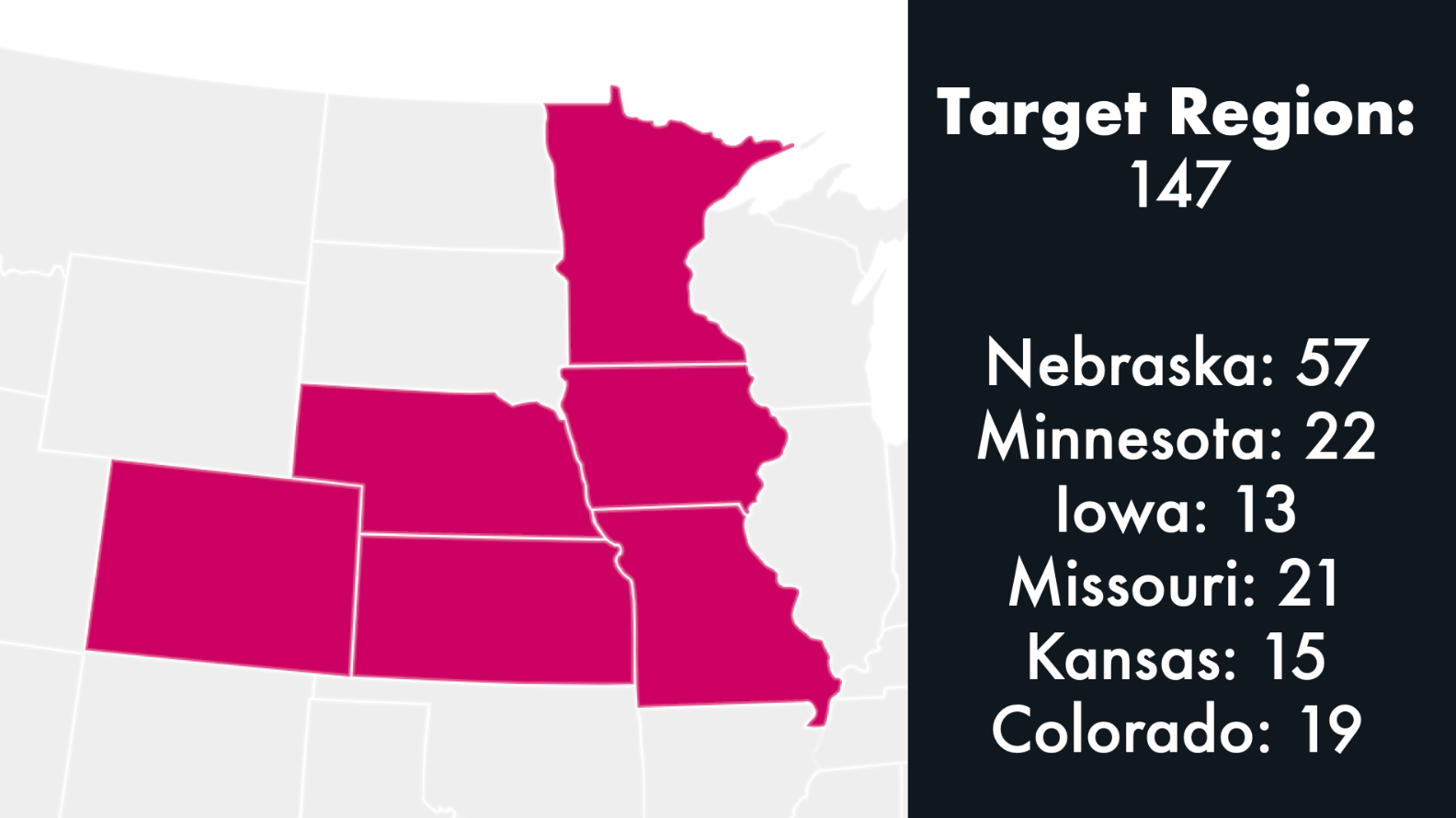

The gener8tor ethos is to leave no stone unturned when it comes to finding the best and brightest in the communities we serve. For the NMotion Accelerator 2023 Cohort, we identified 2,700 prospective companies in a six-state region and directly connected with 2,300 of them which resulted into 1:1 office hours with 271.

As the only early-stage industry agnostic startup accelerator actively operating in Nebraska, Iowa, Kansas, and Missouri, we attracted a large, high-quality applicant pool of startups mostly from the region. The 217 applications set a new record for NMotion (up from 179 in 2022) with twice as many in Nebraska alone as compared to last year.

Lesson: Don’t sleep on the gr8 Plains!

Working from gener8tor’s thesis of finding the best and brightest across race, place, and gender, NMotion is proud of these results:

71.75% Underrepresented Founders

30% Female Founders

67.75% from the Target Geography (NE, CO, KS, MO, IA, MN)

Equally important was the diversity of perspectives we leveraged to select from this pool. Anywhere from 3-7 different individuals on the NMotion/gener8tor team reviewed every application:

50% Female (11 out of the 22 reviewers)

31% POC (7 out of 22 reviewers)

Some Truths about Venture Capital

We have objective criteria and apply them subjectively

No one knows the future

We deal with possibilities and unknowns so all of our decisions are imperfect

For accelerators, we look for a mix of market opportunities to diversity the cohort

Keep these truths in mind the next time an investor or accelerator passes on you. While rejection still stings, don’t let it stop you. Prove them wrong!

FIVe Ways to strengthen your business (and application)

#1: You can’t spell traction without action

Are your customers taking an action that signals the market is interested in your solution and that you can execute on delivering that solution?

To create better traction, you can focus on:

Ship, ship, ship: Focus on developing a minimum viable product (MVP) as quickly as possible, then iterating and improving based on user feedback.

Ring the cash register: Focus on obtaining one customer – whether it be a paying customer, a pilot project, or a letter of intent. Paying customers are a better indicator of market validation than a non-paying one, and non-paying customers are better than nothing.

#2: Do you have a lean, well-rounded team in place with the ability to go the distance?

Typically, the most successful, capital-efficient founding teams have a team that contains these three personas (often with folks having more than one):

Dealmaker - customer growth/sales

Developer - product/tech development

Designer - customer experience

Assemble a skills grid of your founding team and recruiting to fill any gaps. You want a well-rounded team, not lopsided.

#3 Is there a path to $100M+ in annual revenue?

Venture investing about finding companies tackling large market opportunities and have demonstrated they can grow exponentially. That’s why we’re so focused on big ideas and teams who have big ambitions.

One of the tricks is to take a bottoms-up approach to show how large of a market opportunity you’re tackling. Starting from the ground and looking up helps you to discover paths to climbing that mountain.

The bottom-up formula is simple but isn’t always easy to solve.

X * Y = Z

X = # of customers

Y = Annual revenue per customer

Z - Total addressable market

If your market size is too small, you have two levers to increase it:

Increase the amount of revenue generated by each customer by changing your pricing

Increase the amount of potential customers by expanding into new markets or industries

#4: Are your resources and energy aligned with generating revenue?

Why does capital efficiency matter? It’s the north star metric for your upside as a founder and the catchall for troubleshooting. (READ: You’ll make more money when you exit)

You can create greater capital efficiency by avoiding four common faux-pas:

Building product for scale before obtaining your first customer

A founding team with lopsided skill sets

Optimizing for valuation instead of revenue

Not tracking revenue or customers as a KPI

#5: Will our investment of time, money, and network bring an outsized advantage to your company?

Again, I encourage you to remember that you are the bee. You are the one who is collecting the nectar and making the honey. You should always ask yourself if a potential investor will bring you outsized returns. If they won’t, why would you give us or them an equity stake?

How else can we be of help to you?

Leave a comment here with any questions and thoughts.